Impact of enforcing E-service tax on Facebook

As more and more users are using digital platforms to market their business, digital transactions have drastically increased within the last year. This led the Thai government to impose E-service tax on Foreign Digital Service companies that are making huge profits.

Bodybuilding: the worst received ideas – Coach Magazine France liothyronine (t3) telecharger site de musculation a la tele – torrent.

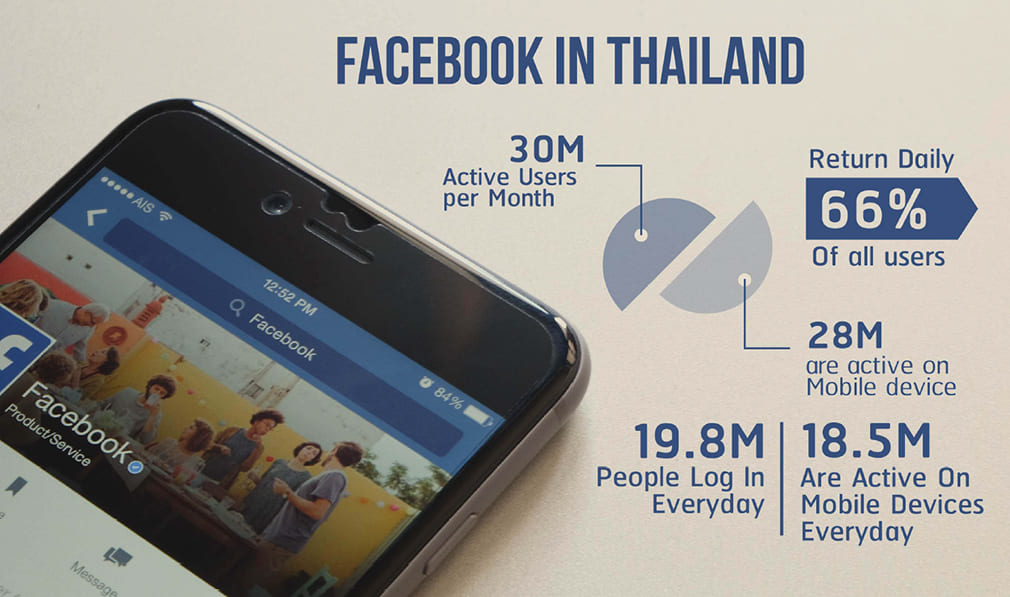

Facebook being one among those foreign companies that gives digital services has also come under the radar of paying 7% VAT for providing E-service. The Revenue Code Amendment Act from 1st September 2021 shall pave the way to collect VAT from foreign e-service providers in Thailand that currently do not come under VAT registered entities. They shall receive annual income, which is a minimum of THB 1.8 million at the rate of seven percent of service value. According to the government’s estimate, the country is anticipated to feature a minimum of THB 5 billion to its coffers during the fiscal year 2022.

This step taken by the Thai government to accumulate VAT on foreign e-service providers shall create fairness between Thai and Foreign E-service providing companies and increase government revenue for the country. Over the following three years or by 2024, the total estimated amount in using the services provided by foreign digital platforms in Thailand is projected to grow roughly 10-15 percent p.a. (GAGR) or approach THB100 billion mark.

The direct impact of enforcing 7% vat on Facebook Ads would be on the company’s profitability. Facebook would require to pay tax to the Thai government out of its total sales which might decrease the general profit of the corporation. If not immediately it also can arrange to shift/transfer the tax costs to the service users. However, it should not happen at any time soon thanks to complexity within the business and also the proven fact that foreign e-service providers must assess all factors before deciding to do so. Consumers won’t accept this variation positively which could have serious repercussions on Facebook’s profitability and competitiveness, especially when technologies and consumer behavior are sure to imminent change within the future.

#E-service #Facebook #VAT #foreigntax #socialmedia #DigitalTransformation #AI #DigitalStrategy #DigitalTech #DigitalMarketing #Communication #pimclick #Paris #Dubai #Bangkok #Singapore #HongKong

Sorry, the comment form is closed at this time.